آشنایی با Visitor Pattern در #C

سه شنبه 8 دی 1394در این مقاله به همراه یک نمونه راجع به الگوی طراحی Visitor صحبت خواهیم کرد.الگوهای طراحی همان طور که میدانید راه حل هایی برای مشکلات تکراری برنامه نویسی است.

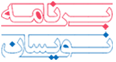

الگو های طراحی همان طور که میدانید راه حل هایی برای مشکلات تکراری برنامه نویسی است .الگوها مسایل تکراری هستند که در شرایطی رخ میدهند.الگوها راه حل هایی را برای این مسائل ارائه می دهند. الگوهای طراحی مسئله را به طور کامل حل نمی کنند بلکه الگوی برای حل آن ارائه می دهند.الگوهای طراحی طبق شکل زیر به سه دسته کلی تقسیم می شوند که در زیر آمده است .

Credential

این الگوها با ساختن اشیا مرتبط هستند .در حین ساخت کلاس اجرای برنامه را به نقطه ای دیگر منتقل می کنند تا یک سری قواعد بر کلاس اعمال گردد.

Structural

روابط بین اشیا و نحوه ترکیب آنها را با یکدیگر بیان می کند .

Behevioral

به ارتباط بین اشیا بر مبنای وظایف آنها و الگوریتم هایشان می پردازد.الگوی طراحی Visitor در این طبقه بندی جای می گیرد.

الگوی طراحی Visitor

اگر بخواهیم به کلاسی بدون اینکه به ساختار آن دست بزنیم متد هایی را اضافه کنیم از این الگو استفاده می کنیم .این الگو تلاش می کند تا بین لایه Business logic (برای آشنایی با مفهوم Business Logic و برنامه نویسی سه لایه به مقاله معماری سه لایه در ASP.NET مراجعه کنید )و الگوریتم جدایی ایجاد کند .ما می توانیم منطق جدیدی به برنامه اضافه کنیم بدون اینکه به ساختار دیتای خود دست بزنیم .

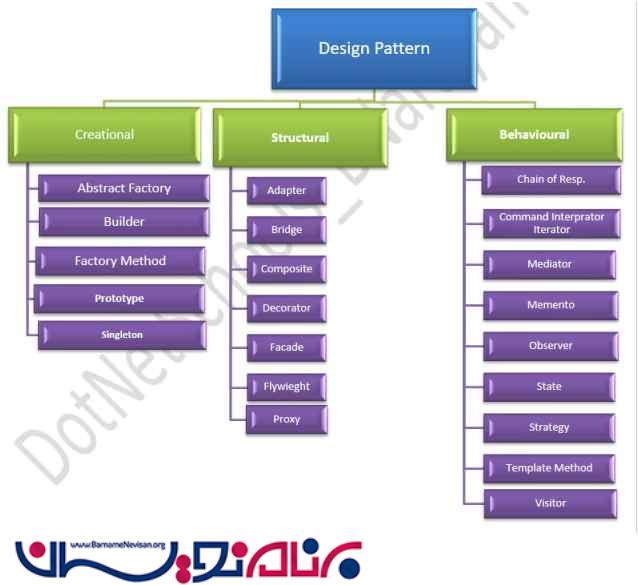

تعریف الگوی طراحی visitor به صورت زیر است

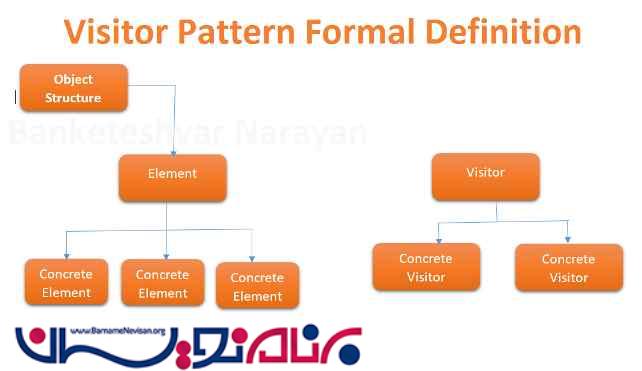

برای درک بیشتر موضوع یک مثال واقعی از حقوق یک کارمند و محاسبه مالیات و خالص حقوق می پردازیم

در زیر visitor سه تابع قرار داده شده است ابتدا آنها را پیاده سازی می کنیم البته در اینجا بدون استفاده از الگوی طراحی visitor

using System;

using System.Collections.Generic;

using System.Globalization;

namespace Earning_TaxInIndiaWithoutVisitorPattern

{

class Program

{

static void Main(string[] args)

{

Employee emp = new Employee

{

EmployeeId = "XYZ1001", EmployeeName = "Banketeshvar Narayan"

};

AddDataForEmployee(emp);#

region Calculate Net Earning of the Year

double NetEarningoftheYear = 0.0;

foreach(var monthlySalary_Earning in emp.MonthlySalary_Earnings)

{

NetEarningoftheYear += (monthlySalary_Earning.BasicSalary + monthlySalary_Earning.ConveyanceAllowance + monthlySalary_Earning.FoodCard_Bill + monthlySalary_Earning.HRAExemption + monthlySalary_Earning.MedicalAllowance + monthlySalary_Earning.OtherBills + monthlySalary_Earning.PersonalAllowance + monthlySalary_Earning.TelephoneBill);

}

foreach(var monthlySalary_Deduction in emp.MonthlySalary_Deductions)

{

NetEarningoftheYear -= (monthlySalary_Deduction.ProvidentFund_EmployeeContribution + monthlySalary_Deduction.ProvidentFund_EmployerContribution + monthlySalary_Deduction.ProfessionTax + monthlySalary_Deduction.OtherDeduction);

}#

endregion# region Calculate TaxableAmount

double TaxableAmount = 0.0;

foreach(var monthlySalary_Earning in emp.MonthlySalary_Earnings)

{

TaxableAmount += (monthlySalary_Earning.BasicSalary + monthlySalary_Earning.HRAExemption + monthlySalary_Earning.MedicalAllowance + monthlySalary_Earning.PersonalAllowance);

//Non Taxable parts

//monthlySalary_Earning.FoodCard_Bill

//monthlySalary_Earning.ConveyanceAllowance

//monthlySalary_Earning.TelephoneBill

//monthlySalary_Earning.OtherBills

}

foreach(var monthlySalary_Deduction in emp.MonthlySalary_Deductions)

{

TaxableAmount -= (monthlySalary_Deduction.ProvidentFund_EmployeeContribution + monthlySalary_Deduction.ProvidentFund_EmployerContribution + monthlySalary_Deduction.ProfessionTax + monthlySalary_Deduction.OtherDeduction);

}

foreach(var monthlyExpense in emp.MonthlyExpenses)

{

TaxableAmount -= monthlyExpense.MonthlyRent;

}

foreach(var annualInvestment in emp.AnnualInvestments)

{

TaxableAmount -= annualInvestment.InvestmentAmmount;

}#

endregion

Console.WriteLine("Annual Net Earning Amount : {0}", NetEarningoftheYear);

Console.WriteLine("Annual Taxable Amount : {0}", TaxableAmount);

}

private static void AddDataForEmployee(Employee emp)

{

for (int i = 1; i <= 12; i++)

{

emp.MonthlySalary_Earnings.Add(new MonthlySalary_Earning

{

MonthName = DateTimeFormatInfo.CurrentInfo.GetMonthName(i),

BasicSalary = 120000,

HRAExemption = 50000,

ConveyanceAllowance = 1600,

PersonalAllowance = 45000,

MedicalAllowance = 1500,

TelephoneBill = 2500,

FoodCard_Bill = 3000,

OtherBills = 35000

});

emp.MonthlySalary_Deductions.Add(new MonthlySalary_Deduction

{

MonthName = DateTimeFormatInfo.CurrentInfo.GetMonthName(i),

ProvidentFund_EmployeeContribution = 8000,

ProvidentFund_EmployerContribution = 8000,

OtherDeduction = 700,

ProfessionTax = 200,

TDS = 15000

});

emp.MonthlyExpenses.Add(new MonthlyExpense

{

MonthName = DateTimeFormatInfo.CurrentInfo.GetMonthName(1), MonthlyRent = 10000

});

}

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "MediclaimPolicy", InvestmentAmmount = 15000

});

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "MediclaimPolicyforParents", InvestmentAmmount = 25000

});

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "HouseLoan", InvestmentAmmount = 0.0

});

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "EducationLoan", InvestmentAmmount = 0.0

});

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "OtherInvestment", InvestmentAmmount = 5000

});

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "RGESS", InvestmentAmmount = 5500

});

emp.AnnualInvestments.Add(new AnnualInvestment

{

InvestmentDetails = "Section80Cn80CCD_ExceptPF", InvestmentAmmount = 100000

});

//emp.AnnualInvestments.Add(new AnnualInvestment

//{

// //MediclaimPolicy = 15000,

// //MediclaimPolicyforParents = 25000,

// //HouseLoan = 0.0,

// //EducationLoan = 0.0,

// //OtherInvestment = 5000,

// //RGESS = 5500,

// //Section80Cn80CCD_ExceptPF = 100000

//});

}

}#

region Employee

public class Employee

{

public string EmployeeId

{

get;

set;

}

public string EmployeeName

{

get;

set;

}

public List < MonthlySalary_Earning > MonthlySalary_Earnings = new List < MonthlySalary_Earning > ();

public List < MonthlySalary_Deduction > MonthlySalary_Deductions = new List < MonthlySalary_Deduction > ();

public List < AnnualInvestment > AnnualInvestments = new List < AnnualInvestment > ();

public List < MonthlyExpense > MonthlyExpenses = new List < MonthlyExpense > ();

}#

endregion# region MonthlySalary_Earning

public class MonthlySalary_Earning

{

public string MonthName

{

get;

set;

}

public double BasicSalary

{

get;

set;

}

public double HRAExemption

{

get;

set;

}

public double ConveyanceAllowance

{

get;

set;

}

public double PersonalAllowance

{

get;

set;

}

public double MedicalAllowance

{

get;

set;

}

public double TelephoneBill

{

get;

set;

}

public double FoodCard_Bill

{

get;

set;

}

public double OtherBills

{

get;

set;

}

}#

endregion# region MonthlySalary_Deduction

public class MonthlySalary_Deduction

{

public string MonthName

{

get;

set;

}

public double ProvidentFund_EmployeeContribution

{

get;

set;

}

public double ProvidentFund_EmployerContribution

{

get;

set;

}

public double ProfessionTax

{

get;

set;

}

public double TDS

{

get;

set;

}

public double OtherDeduction

{

get;

set;

}

}#

endregion# region AnnualInvestment

public class AnnualInvestment

{

public string InvestmentDetails

{

get;

set;

}

public double InvestmentAmmount

{

get;

set;

}

//public double MediclaimPolicy { get; set; }

//public double MediclaimPolicyforParents { get; set; }

//public double HouseLoan { get; set; }

//public double EducationLoan { get; set; }

//public double Section80Cn80CCD_ExceptPF { get; set; }

//public double RGESS { get; set; }

//public double OtherInvestment { get; set; }

}#

endregion# region MonthlyExpense

public class MonthlyExpense

{

public string MonthName

{

get;

set;

}

public double MonthlyRent

{

get;

set;

}

}#

endregion

}

حال همان متد های بالا را با کمک الگوی طراحی Visitor دوباره نویسی می کنیم

using System;

using System.Collections.Generic;

using System.Globalization;

namespace Earning_TaxationInIndiaWithVisitorPattern

{

class Program

{

static void Main(string[] args)

{

Employee emp = new Employee

{

EmployeeId = "XYZ1001", EmployeeName = "Banketeshvar Narayan Sharma"

};

AddDataForEmployee(emp);

var netAnnualEarningVisitor = new NetAnnualEarningVisitor();

var annualTaxableAmount = new TaxableAmountVisitor();

emp.Accept(netAnnualEarningVisitor);

emp.Accept(annualTaxableAmount);

Console.WriteLine("Annual Net Earning Amount : {0}", netAnnualEarningVisitor.NetEarningoftheYear);

Console.WriteLine("Annual Taxable Amount : {0}", annualTaxableAmount.TaxableAmount);

Console.ReadKey();

}

private static void AddDataForEmployee(Employee emp)

{

for (int i = 1; i <= 12; i++)

{

emp.Salaries.Add(new MonthlySalary_Earning

{

MonthName = DateTimeFormatInfo.CurrentInfo.GetMonthName(i),

BasicSalary = 120000,

HRAExemption = 50000,

ConveyanceAllowance = 1600,

PersonalAllowance = 45000,

MedicalAllowance = 1500,

TelephoneBill = 2500,

FoodCard_Bill = 3000,

OtherBills = 35000

});

emp.Salaries.Add(new MonthlySalary_Deduction

{

MonthName = DateTimeFormatInfo.CurrentInfo.GetMonthName(i),

ProvidentFund_EmployeeContribution = 8000,

ProvidentFund_EmployerContribution = 8000,

OtherDeduction = 700,

ProfessionTax = 200,

TDS = 15000

});

emp.Salaries.Add(new MonthlyExpense

{

MonthName = DateTimeFormatInfo.CurrentInfo.GetMonthName(1), MonthlyRent = 10000

});

}

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "MediclaimPolicy", InvestmentAmmount = 15000

});

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "MediclaimPolicyforParents", InvestmentAmmount = 25000

});

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "HouseLoan", InvestmentAmmount = 0.0

});

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "EducationLoan", InvestmentAmmount = 0.0

});

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "OtherInvestment", InvestmentAmmount = 5000

});

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "RGESS", InvestmentAmmount = 5500

});

emp.Salaries.Add(new AnnualInvestment

{

InvestmentDetails = "Section80Cn80CCD_ExceptPF", InvestmentAmmount = 100000

});

}

}

public class NetAnnualEarningVisitor: IVisitor

{

public double NetEarningoftheYear

{

get;

set;

}

public void Visit(MonthlySalary_Earning monthlySalary_Earning)

{

NetEarningoftheYear += (monthlySalary_Earning.BasicSalary + monthlySalary_Earning.ConveyanceAllowance + monthlySalary_Earning.FoodCard_Bill + monthlySalary_Earning.HRAExemption + monthlySalary_Earning.MedicalAllowance + monthlySalary_Earning.OtherBills + monthlySalary_Earning.PersonalAllowance + monthlySalary_Earning.TelephoneBill);

}

public void Visit(MonthlySalary_Deduction monthlySalary_Deduction)

{

NetEarningoftheYear -= (monthlySalary_Deduction.ProvidentFund_EmployeeContribution + monthlySalary_Deduction.ProvidentFund_EmployerContribution + monthlySalary_Deduction.ProfessionTax + monthlySalary_Deduction.OtherDeduction);

}

public void Visit(AnnualInvestment annualInvestment)

{

// do nothing

}

public void Visit(MonthlyExpense monthlyExpense)

{

//do nothing

}

}

public class TaxableAmountVisitor: IVisitor

{

public double TaxableAmount

{

get;

set;

}

public void Visit(MonthlySalary_Earning monthlySalary_Earning)

{

TaxableAmount += (monthlySalary_Earning.BasicSalary + monthlySalary_Earning.HRAExemption + monthlySalary_Earning.MedicalAllowance + monthlySalary_Earning.PersonalAllowance);

}

public void Visit(MonthlySalary_Deduction monthlySalary_Deduction)

{

TaxableAmount -= (monthlySalary_Deduction.ProvidentFund_EmployeeContribution + monthlySalary_Deduction.ProvidentFund_EmployerContribution + monthlySalary_Deduction.ProfessionTax + monthlySalary_Deduction.OtherDeduction);

}

public void Visit(MonthlyExpense monthlyExpense)

{

TaxableAmount -= monthlyExpense.MonthlyRent;

}

public void Visit(AnnualInvestment annualInvestment)

{

TaxableAmount -= annualInvestment.InvestmentAmmount;

}

}

public interface ISalary

{

void Accept(IVisitor visitor);

}

public interface IVisitor

{

void Visit(MonthlySalary_Earning monthlySalary_Earning);

void Visit(MonthlySalary_Deduction monthlySalary_Deduction);

void Visit(MonthlyExpense monthlyExpense);

void Visit(AnnualInvestment annualInvestment);

}#

region Employee

public class Employee: ISalary

{

public string EmployeeId

{

get;

set;

}

public string EmployeeName

{

get;

set;

}

public List < ISalary > Salaries = new List < ISalary > ();

public void Accept(IVisitor visitor)

{

foreach(var salary in Salaries)

{

salary.Accept(visitor);

}

}

}#

endregion# region MonthlySalary_Earning

public class MonthlySalary_Earning: ISalary

{

public string MonthName

{

get;

set;

}

public double BasicSalary

{

get;

set;

}

public double HRAExemption

{

get;

set;

}

public double ConveyanceAllowance

{

get;

set;

}

public double PersonalAllowance

{

get;

set;

}

public double MedicalAllowance

{

get;

set;

}

public double TelephoneBill

{

get;

set;

}

public double FoodCard_Bill

{

get;

set;

}

public double OtherBills

{

get;

set;

}

public void Accept(IVisitor visitor)

{

visitor.Visit(this);

}

}#

endregion# region MonthlySalary_Deduction

public class MonthlySalary_Deduction: ISalary

{

public string MonthName

{

get;

set;

}

public double ProvidentFund_EmployeeContribution

{

get;

set;

}

public double ProvidentFund_EmployerContribution

{

get;

set;

}

public double ProfessionTax

{

get;

set;

}

public double TDS

{

get;

set;

}

public double OtherDeduction

{

get;

set;

}

public void Accept(IVisitor visitor)

{

visitor.Visit(this);

}

}#

endregion# region AnnualInvestment

public class AnnualInvestment: ISalary

{

public string InvestmentDetails

{

get;

set;

}

public double InvestmentAmmount

{

get;

set;

}

public void Accept(IVisitor visitor)

{

visitor.Visit(this);

}

}#

endregion# region MonthlyExpense

public class MonthlyExpense: ISalary

{

public string MonthName

{

get;

set;

}

public double MonthlyRent

{

get;

set;

}

public void Accept(IVisitor visitor)

{

visitor.Visit(this);

}

}#

endregion

}

- C#.net

- 3k بازدید

- 2 تشکر